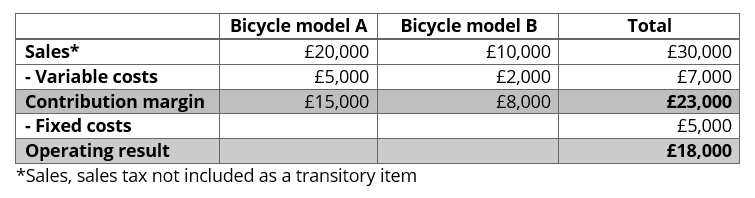

Here, we are calculating the contribution margin on a per-unit basis, but the same values would be obtained if we had used the total figures instead. Next, the CM ratio can be calculated by dividing the amount from the prior step by the price per unit. The analysis of the contribution margin facilitates a more in-depth, granular understanding of a company’s unit economics (and cost structure). 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

What is the approximate value of your cash savings and other investments?

She is a former CFO for fast-growing tech companies with Deloitte audit experience. Barbara has an MBA from The University of Texas and an active CPA license. When she’s not writing, Barbara likes to research public companies and play Pickleball, Texas Hold ‘em poker, bridge, and Mah Jongg. Find out what a contribution margin is, why it is important, and how to calculate it.

What is the Contribution Margin Ratio?

For example, analysts can calculate the margin per unit sold and use forecast estimates for the upcoming year to calculate the forecasted profit of the company. This is the net amount that the company expects to receive from its total sales. Some income statements report net sales as the only sales figure, while others actually report total sales and make deductions for returns and allowances.

Bankrate logo

- The contribution margin and the gross profit margin are both analysis tools used to help businesses increase profits, but they measure different aspects of a business.

- The contribution margin excludes fixed costs, so the expenses to calculate the contribution margin will likely always be less than the gross margin.

- All of these new trends result in changes in the composition of fixed and variable costs for a company and it is this composition that helps determine a company’s profit.

- Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.

The contribution margin represents the revenue that a company gains by selling each additional unit of a product or good. This is one of several metrics that companies and investors use to make data-driven decisions about their business. As with other figures, it is important to consider contribution margins in relation to other metrics rather than in isolation. For example, if sales double, variable costs double too, and vice versa. Direct variable costs include direct material cost and direct labor cost. The contribution margin is the amount of revenue in excess of variable costs.

These can fluctuate from time to time, such as the cost of electricity or certain supplies that depend on supply chain status. Managerial accountants also use the contribution margin ratio to calculate break-even points in the break-even analysis. Get instant access to video lessons taught by experienced investment bankers.

Here’s an example, showing a breakdown of Beta’s three main product lines. Profit margin is calculated using all expenses that directly go into producing the product. To calculate contribution margin (CM) by product, calculate it for each product on a per-unit basis.

While contribution margins only count the variable costs, the gross profit margin includes all of the costs that a company incurs in order to make sales. Contribution margin (sales revenue minus variable costs) is used to evaluate, add and remove products from a company’s product line and make pricing and sales decisions. Management accountants identify financial statement costs and expenses into variable and fixed classifications. Variable costs vary with the volume of activity, such as the number of units of a product produced in a manufacturing company. The contribution margin subtracts the variable costs for producing a single product from revenue.

The contribution margin measures the profitability of individual items that a company makes and sells. This margin reviews the variable costs included in the production cost and a per-item profit metric, whereas gross margin is a company’s total profit metric. Assume that League Recreation, Inc, a sports equipment manufacturing company, has total annual sales and service revenue of $2,680,000 for all of its sports products. Let’s examine how all three approaches convey the same financial performance, although represented somewhat differently.

In such cases, the price of the product should be adjusted for the offering to be economically viable. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

At the product level In a manufacturing company, variable costs change, depending on the volume of production. As more units are produced, total variable costs for the product increase. Expressing the contribution margin as a percentage is called the contribution margin ratio. This is the percentage of revenue remaining after the variable costs have been covered. It can be calculated using either the unit contribution margin or the total contribution margin. Contribution margin is the revenue that is generated beyond what is necessary to cover the variable costs of production, such as materials and non-salaried labor costs.

Use contribution margin alongside gross profit margin, your balance sheet, and other financial metrics and analyses. This is the only real way to determine whether your company is profitable in the short and long term and if you need to make widespread changes to your profit models. Consider its name — the contribution margin is how much the sale of a particular product or service contributes to your best accounting software in 2021 company’s overall profitability. Watch this video from Investopedia reviewing the concept of contribution margin to learn more. Keep in mind that contribution margin per sale first contributes to meeting fixed costs and then to profit. If a company has $2 million in revenue and its COGS is $1.5 million, gross margin would equal revenue minus COGS, which is $500,000 or ($2 million – $1.5 million).

Kommentare