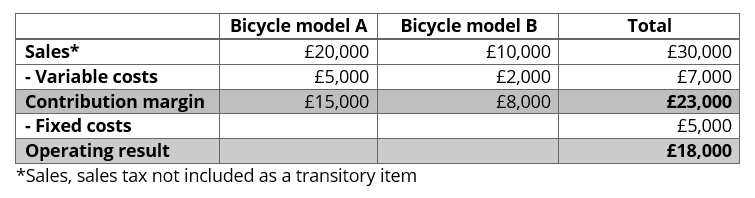

You can use a spreadsheet, such as Google Sheets or Microsoft Excel, to include columns by product, enabling you to compare the contribution margin for each of your business products. The contribution margin can be expressed as the number of dollars as we have seen, but it can also be presented as a percentage. Contribution margin is also often used to determine the break-even point and the sales understanding accounts payable ap with examples and how to record ap volume required to earn a target profit. Furthermore, a contribution margin tells you how much extra revenue you make by creating additional units after reaching your break-even point. Below is a breakdown of contribution margins in detail, including how to calculate them. This metric is typically used to calculate the break even point of a production process and set the pricing of a product.

What is your current financial priority?

A low margin typically means that the company, product line, or department isn’t that profitable. An increase like this will have rippling effects as production increases. Management must be careful and analyze why CM is low before making any decisions about closing an unprofitable department or discontinuing a product, as things could change in the near future. Gross profit is the dollar difference between net revenue and cost of goods sold. Gross margin is the percent of each sale that is residual and left over after the cost of goods sold is considered. The former is often stated as a whole number, while the latter is usually a percentage.

Example: contribution margin and target profit

The contribution margin ratio is calculated as (Revenue – Variable Costs) / Revenue. Fixed costs are often considered sunk costs that once spent cannot be recovered. These cost components should not be considered while making decisions about cost analysis or profitability measures. To see an example of how a firm can use the contribution margin in analyzing operating profit let’s continue to use the bottled drink example from above. Once you calculate your contribution margin, you can determine whether one product or another is ultimately better for your bottom line.

Let’s get more productive

- Similarly, we can then calculate the variable cost per unit by dividing the total variable costs by the number of products sold.

- When the contribution margin is expressed as a percentage of sales, it is called the contribution margin ratio or profit-volume ratio (P/V ratio).

- To calculate the unit contribution margin, you subtract the variable costs per unit from the selling price per unit.

- It’s also a helpful metric to track how sales affect profits over time.

The break even point (BEP) is the number of units at which total revenue (selling price per unit) equals total cost (fixed costs + variable cost). If the selling price per unit is more than the variable cost, it will be a profitable venture otherwise it will result in loss. Jump, Inc. is a sports footwear startup which currently sells just one shoe brand, A. The sales price is $80, variable costs per unit is $50 and fixed costs are $2,400,000 per annum (25% of the which are manufacturing overhead costs) . Two ways a company assesses profits are gross margin and contribution margin.

What is the approximate value of your cash savings and other investments?

Investors and analysts may also attempt to calculate the contribution margin figure for a company’s blockbuster products. For instance, a beverage company may have 15 different products but the bulk of its profits may come from one specific beverage. You need to work out the contribution margin per unit, the increase in profit if there is a one unit increase in sales. For League Recreation’s Product A, a premium baseball, the selling price per unit is $8.00. Calculate contribution margin for the overall business, for each product, and as a contribution margin ratio.

As we said earlier, variable costs have a direct relationship with production levels. Variable costs are not typically reported on general purpose financial statements as a separate category. Thus, you will need to scan the income statement for variable costs and tally the list. Some companies do issue contribution margin income statements that split variable and fixed costs, but this isn’t common.

Fixed costs remained unchanged; however, as more units are produced and sold, more of the per-unit sales price is available to contribute to the company’s net income. The difference between the selling price and variable cost is a contribution, which may also be known as gross margin. The contribution margin is computed by using a contribution income statement, a management accounting version of the income statement that has been reformatted to group together a business’s fixed and variable costs.

After you’ve completed the unit contribution margin calculation, you can also determine the contribution margin by product in total dollars. A subcategory of fixed costs is overhead costs that are allocated in GAAP accounting to inventory and cost of goods sold. This allocation of fixed overhead isn’t done for internal analysis of contribution margin. Fixed costs usually stay the same no matter how many units you create or sell.

They also use this to forecast the profits of the budgeted production numbers after the prices have been set. The 60% CM ratio implies the contribution margin for each dollar of revenue generated is $0.60. The greater the contribution margin (CM) of each product, the more profitable the company is going to be, with more cash available to meet other expenses — all else being equal. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

Gross margin encompasses all costs of a specific product, while contribution margin encompasses only the variable costs of a good. While gross profit is more useful in identifying whether a product is profitable, contribution margin can be used to determine when a company will break even or how well it covers fixed costs. Using this formula, the contribution margin can be calculated for total revenue or for revenue per unit. For instance, if you sell a product for $100 and the unit variable cost is $40, then using the formula, the unit contribution margin for your product is $60 ($100-$40). This $60 represents your product’s contribution to covering your fixed costs (rent, salaries, utilities) and generating a profit. The contribution margin is different from the gross profit margin, the difference between sales revenue and the cost of goods sold.

Similarly, we can then calculate the variable cost per unit by dividing the total variable costs by the number of products sold. Break even point (BEP) refers to the activity level at which total revenue equals total cost. Contribution margin is the variable expenses plus some part of fixed costs which is covered. Thus, CM is the variable expense plus profit which will incur if any activity takes place over and above BEP.

Kommentare