Articles

Washington (AP) — The newest Biden management wants to create domestic a home purchases much more transparent by unmasking the owners from particular all the-cash sales. It’s section of a continuing efforts to battle currency laundering and you will the brand new direction away from dirty money through the American financial system. Service of one’s Treasury and condition banking regulators to add their members having a safe, secure fee provider. The company have posted the newest securities, funded the money reserves, used currency laundering identification options, dependent OFAC tests, and you will finished the brand new banking regulation and you can economic audits to run because the a low-lender financial institution.

Starting within the industrial a property

If you don’t has a bank account, visit Internal revenue service.gov/DirectDeposit for additional info on finding a lender or borrowing connection that can open a free account online. You could potentially prepare yourself the new income tax come back on your own, see if you qualify for 100 percent free income tax preparation, or get a taxation elite group to prepare the come back. A great blanket withholding certificate can be awarded if the transferor carrying the newest USRPI will bring a keen irrevocable letter from credit otherwise a promise and you can adopts a tax commission and security arrangement to your Irs.

Buy Unmarried-Loved ones Property

Inside the a scene in which timing things, locating the best solution can alter everything. A button downside out of a REIT is the fact it will dispersed at least 90% of their taxable income as the returns, which constraints its ability to reinvest earnings to own gains. This can constrain enough time-identity money love than the other stocks. An alternative choice to own investing residential REITs is always to spend money on an enthusiastic ETF one spends inside domestic REIT brings.

Another type of earnings acquired from the a different authorities is actually subject to section step 3 withholding. A protected expatriate must have provided your which have Function W-8CE alerting you of the safeguarded expatriate condition and also the facts that they may getting susceptible to special tax laws and regulations in accordance to specific items. “Willfully” in such a case setting willingly, consciously, and you may intentionally. You are pretending willfully for many who spend most other expenditures of your company instead of the withholding taxation. Such, when the a believe will pay wages, for example certain types of retirement benefits, supplemental unemployment shell out, otherwise resigned spend, plus the person to have who the support had been performed has no judge control over the brand new fee of your wages, the fresh faith is the workplace.

Industrial property money tend to be pretty tight that will need you inform you a positive track record that have home-based home basic, on top of placing additional money off. It’s and an excellent riskier financing, as possible more challenging to locate tenants, and commercial characteristics are more likely to end up being influenced by terrible economic conditions. The majority of people searching for college student a house investing start out with belongings, and valid reason. The newest hindrance so you can entry is gloomier one another economically plus terms of expertise level. Off repayments is notably smaller, and you will specific individuals could even qualify for deposit assistance software you to definitely aren’t readily available for commercial a home. What’s a lot more, it’s typically in an easier way to qualify for a home loan than simply a professional real estate loan.

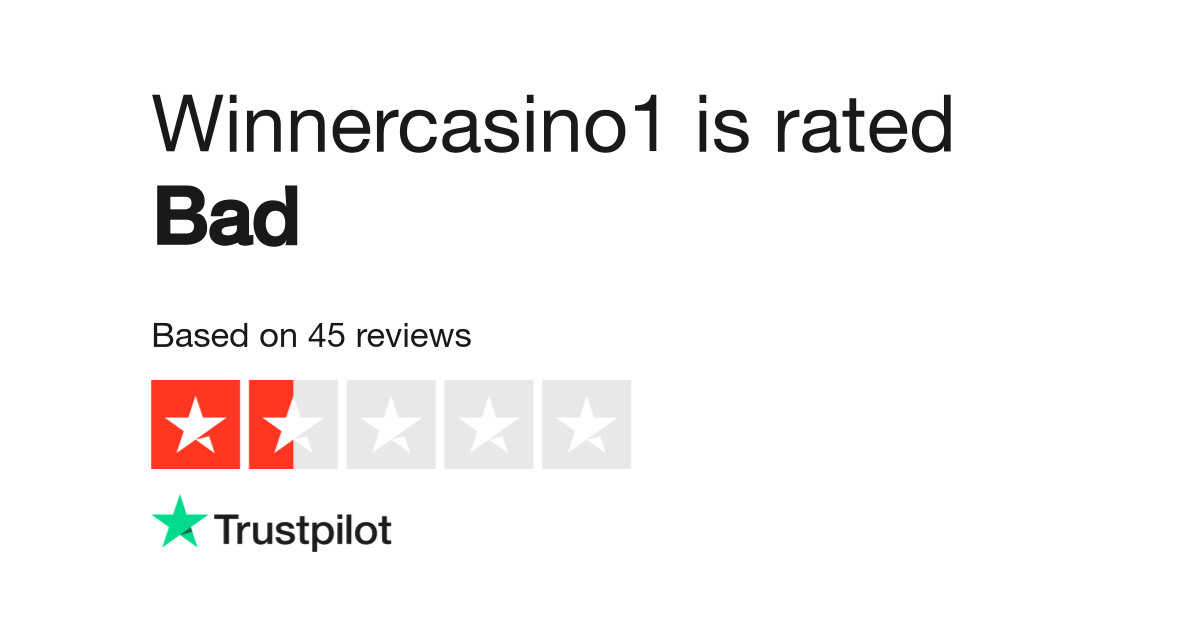

There should be an https://passion-games.com/casino-on-net/ equilibrium between what is actually being offered since the an advantage and what you need to do to change one to extra to your a real income. We Listing Precisely the Registered OperatorsAll casino poker internet sites the next features started subscribed and you may official by the designated jurisdictions and you may government, guaranteeing the protection, legality, and you will equity of these internet sites in addition to their poker online game. What’s more, i research the reputation of those sites to be sure players are happy on the services offered and you can procedures. Simply even as we make sure the web site presses all of the best packages do we expose they right here.

Withholding foreign partnerships and withholding overseas trusts aren’t flow-due to organizations. A payer data an income tax get back for the Function 945 so you can declaration backup withholding. An excellent U.S. relationship will be keep back when one withdrawals that come with quantity susceptible to withholding are built. You can change bare room oneself property to the rental room also known as connection dwelling equipment. Because of the upgrading the cellar, lost, or other area for the an excellent livable tool, you might draw in rent-investing tenants. In addition is generate a visitor house since the an enthusiastic ADU when the you have enough free space for the possessions you currently very own.

Genisys Borrowing Partnership *

Treasury has also been responsible for undertaking most other visibility-related efforts, including the rollout out of an alternative database for the small business possession. The new therefore-named helpful control registry is expected in order to contain information that is personal on the proprietors with a minimum of 32 million You.S. enterprises. One learn from the fresh feeling of cash laundering to the home prices in the Canada, conducted by a team of Canadian teachers, found that money laundering investment within the a property pressed upwards property costs regarding the list of step 3.7% to help you 7.5%. Home try a commonly used auto for money laundering, on account of opaque reporting laws and regulations to the purchases.

Organizations in the a property field is always to get ready for the fresh implementation associated with the final code because of the reviewing the newest AML techniques, distinguishing jobs that may trigger reporting financial obligation, and you will setting up ways to adhere to the new requirements. FinCEN provides provided Faqs to simply help stakeholders browse the fresh rule’s complexities. Because it’s supported by physical, lead home and offers smaller prominent-representative dispute or the the amount that the interest of one’s trader is dependant on the newest ethics and ability away from professionals and you may debtors.

However with all the different states allowing some other providers, something can get a small dirty on the inexperienced poker players in the usa. Such as regular bonus-investing carries, REITs are a solid funding to own traders who search normal earnings. On the in addition to front side, because the possessions initiate introducing cash, it could be leveraged discover much more assets. Slowly, the brand new buyer can buy loads of income avenues out of multiple features, offsetting unanticipated costs and you can loss having the brand new money.

Unsecured Organization Mortgage

The industry struggled inside 2008 financial crisis, and then noted REITs replied if you are paying out of debt and re also-equitizing the balance sheets by the promoting inventory for cash. Noted REITs and REOCs raised $37.5 billion in the 91 secondary guarantee offerings, nine IPOs and you may 37 consumer debt choices since the buyers proceeded in order to work positively to businesses strengthening the balance sheets pursuing the borrowing from the bank crisis. A collaboration is an excellent “resident” of Maine in the event the no less than 75% of your own control of this partnership is held from the Maine owners.

A good U.S. believe is required to keep back to the count includible in the gross income from a foreign recipient to the the amount the newest trust’s distributable net income contains an amount subject to withholding. To your the amount a good You.S. faith is required to dispersed an expense at the mercy of withholding however, will not actually spread the total amount, it should keep back for the international beneficiary’s allocable display at the time the money is needed to be advertised for the Form 1042-S. If the a price at the mercy of chapter 3 withholding is additionally an excellent withholdable payment and chapter 4 withholding is actually placed on the newest commission, no withholding becomes necessary less than section step 3. Sobrato become selling home inside the Palo Alto as the a student at the Santa Clara College or university, at some point getting into developing industrial functions close to their mom ahead of founding the newest Sobrato Team in the 1979.